Atal Pension Yojana was started by the Prime Minister of our country, Shri Narendra Modi, on June 1, 2015. Under this scheme, after the age of 60 of the beneficiaries, an amount ranging from Rs 1000 to Rs 5000 will be given as a pension. At Atal Pension Yojana 2021, the amount of the pension will be decided according to the age and the investment made by the beneficiaries. In Atal Pension Yojana 2021, not only can you be entitled to more pension each month by depositing less, but you can also take the benefit of it to your family in case of premature death. For more information on this scheme, such as the amount chart, the registration process, the eligibility, the required documents, etc., please read this article carefully until the end.

This scheme was started for citizens of the unorganized sector. To benefit from this scheme, the beneficiary must have a savings account at the bank. To benefit from the Atal Pension Yojana, the age of the husband and wife must be between 18 and 40 years old.

|

Scheme Name |

Atal Pension Yojana |

|

Starting Date |

2015 Year |

|

Who Started |

Central Government |

|

Beneficiary |

people from the unorganized sectors of the country |

|

Goal |

Provide Pension |

|

Blog Updated |

November, 2021 |

Just like the national pension plan, if you spend money on Atal Pension Yojana, tax advantages. these tax benefits can be supplied under phase 80 CCD (1B) of the profits Tax Act. An income tax deduction of ₹ 50,000 may be supplied to the investor under segment 80 CCD (1B).

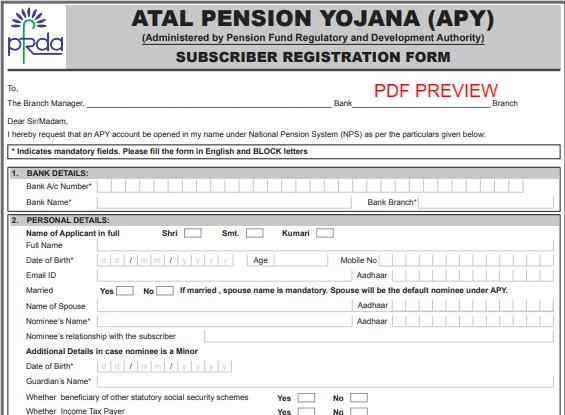

To enroll in Atal Pension Yojana 2021, beneficiaries are required to have a financial institution account and the financial institution account should be connected to the Aadhar card. people who are earnings tax payers and have authorities jobs cannot advantage from this scheme, whoever is the interested beneficiary can go to any national pension bank in India.

Atal Pension Yojana changed into commenced to offer pensions to personnel inside the unorganized zone. through this scheme, a pension of ₹ a thousand to ₹ 5000 is supplied each month in line with the applicant's funding upon turning 60 years of age. Tax blessings will also be furnished to clients beneath this scheme. This information has been supplied via the Regulatory Authority and development of Pension budget thru a tweet. in this tweet, it's been stated that each one those taxpayers of profits tax who're among 18 and forty years vintage can take gain of this scheme and together with this, all the ones taxpayers of the tax ba eighty CC income tax. Act can gain from this scheme. you could also make a income on prices.

To advantage from this scheme, it is obligatory for the consumer to have a financial savings account or financial savings account at the publish office. Atal Pension Yojana has additionally been covered in Article 7 of the Aadhaar regulation. All those residents who need to apply under this scheme should gift proof of their Aadhaar wide variety or need to undergo registration below the Aadhaar authentication.

|

Age of entry |

Years of contribution |

First Monthly pension of Rs.1000/- |

Second Monthly pension of Rs.2000/- |

Third Monthly pension of Rs.3000/- |

Fourth Monthly pension of Rs.4000/- |

Fifth Monthly pension of Rs.5000/- |

|

18 |

42 |

42 |

84 |

126 |

168 |

210 |

|

19 |

41 |

46 |

92 |

138 |

183 |

224 |

|

20 |

40 |

50 |

100 |

150 |

198 |

248 |

|

21 |

39 |

54 |

108 |

162 |

215 |

269 |

|

22 |

38 |

59 |

117 |

177 |

234 |

292 |

|

23 |

37 |

64 |

127 |

192 |

254 |

318 |

|

24 |

36 |

70 |

139 |

208 |

277 |

346 |

|

25 |

35 |

76 |

151 |

226 |

301 |

376 |

|

26 |

34 |

82 |

164 |

246 |

327 |

409 |

|

27 |

33 |

90 |

178 |

268 |

356 |

446 |

|

28 |

32 |

97 |

194 |

292 |

388 |

485 |

|

29 |

31 |

106 |

212 |

318 |

423 |

529 |

|

30 |

30 |

116 |

231 |

347 |

462 |

577 |

|

31 |

29 |

126 |

252 |

379 |

504 |

630 |

|

32 |

28 |

138 |

276 |

414 |

551 |

689 |

|

33 |

27 |

151 |

302 |

453 |

602 |

752 |

|

34 |

26 |

165 |

330 |

495 |

659 |

824 |

|

35 |

25 |

181 |

362 |

543 |

722 |

902 |

|

36 |

24 |

198 |

396 |

594 |

792 |

990 |

|

37 |

23 |

218 |

436 |

654 |

870 |

1087 |

|

38 |

22 |

240 |

480 |

720 |

957 |

1196 |

|

39 |

21 |

264 |

528 |

792 |

1054 |

1318 |

|

40 |

20 |

291 |

582 |

873 |

1164 |

1454 |

Website - NA

Fax No. - NA

Email Id - NA

Address - NA

.webp)