Best Life Insurance for Cancer Patients (2023): While having a family history of cancer will not preclude you from obtaining life insurance, can I get cancer insurance after diagnosis with cancer will make it more difficult to qualify? Depending on the type of cancer and how long you've been there in remission, your diagnosis may boost your rates or prevent you from obtaining a typical life insurance policy. If you are presently getting treatment, your sole alternative is a guaranteed issue life insurance coverage that does not evaluate your condition. However, it is advisable to deal directly with an agent to locate the best insurance for your needs.

The best option for nationwide coverage: BlueCross BlueShield

Insurance with No Enrollment Period: Sidecar

Best for Getting to Know Kaiser Specialists: Kaiser Permanente

Same-day service is available: UnitedHealthcare

The best option for travelers that require global coverage: Cigna

Step 1: Examine the coverage:

Choose a cancer insurance coverage that includes medical treatments, drugs, radiation therapy, chemotherapy, and hospitalization.

Step 2: Look over the terms and conditions:

Examine the cancer insurance policy's waiting time. Cancer insurance policies include a stipulation about the surviving time. It specifies the number of days the policyholder must survive after being diagnosed.

Step 3: Determine the length of the insurance coverage:

It is critical to select a cancer insurance policy that provides long-term coverage.

Step 4: Examine the insurance policy payments:

This is significant since the rewards for early-stage diagnostic and advanced-stage diagnosis differ. Even mild problems should be covered and compensated for under the specified cancer insurance coverage.

Step 5: Examine the insurer's claim settlement ratio (CSR):

When a cancer patient purchases a cancer insurance plan, choose one with a high claim settlement ratio.

Step 6: Examine the premiums:

Choose a policy that provides comprehensive coverage at a reasonable price.

The finest cancer insurance packages provide a slew of extras. Here are some of the most significant benefits of having a solo cancer insurance policy:

1. Payment of a lump sum

A cancer insurance policy might provide a lump sum payment if the disease is detected early. The payoff amount is normally 20% to 25% of the predetermined total covered.

During the terminal or severe stage of the sickness, you will get the remaining amount of the money covered. Certain cancer insurance policy providers additionally give free check-ups for the duration of the policy.

2. Comprehensive Financial Protection

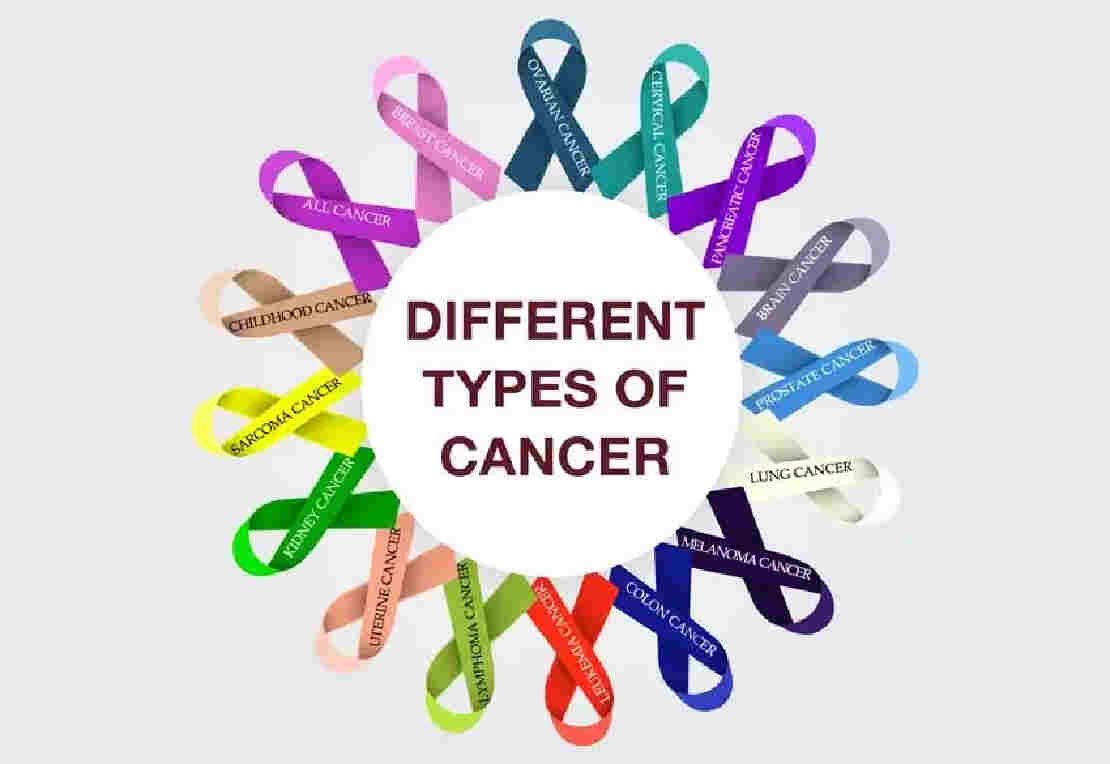

Except for a few exceptions, such as skin cancer, most cancer insurance policies cover many forms of cancer. These are frequently available at a reasonable cost. As a consequence, you may anticipate financial protection against a wide range of costly cancer treatments, including chemotherapy, radiation, surgery, and others.

3. Tax Advantages

If you have a cancer insurance coverage, you are entitled for tax advantages under Section 80D of the Income Tax Act. A tax deduction of up to Rs.25,000 is available. Senior persons, on the other hand, are entitled to greater tax breaks.

4. Consistent Source of Income

Some cancer insurance policies also include income replacement features in the event of a job loss due to a cancer diagnosis. The income benefit function provides a consistent and dependable source of income. Notably, this payout will be a predetermined proportion of the insured amount.

5. Premium Benefit Waiver

There are several cancer insurance policies available in India that, under certain conditions, would waive premium payments for a specified period of time. ranging from 3 to 5 years, or even throughout the whole policy term.

Cancer insurance expenses are often incurred through the payment of a monthly fee. If you pick a firm that also handles your general medical insurance, you may be able to pay for all policies with a single payment. When considering the viability of cancer insurance prices, consider not just what you can pay each month, but also the policy's worth.

For example, if the insurance pays a $10,000 lump payment but you might pay the same amount in total by retaining the policy for a decade, it could not be cost-effective. Some insurance may provide value by providing a lump amount for preventative care. You would not need to be diagnosed as cancer to benefit from the coverage.

.webp)