Kisan Credit Card Yojna 2021 Online Application | Kisan Credit Card Yojna Beneficiary List | Kisan Credit Card Yojna Registration Process | Kisan Credit Card YojnaList | KCCY List

Kisan Credit Card Yojana 2021

The government has established a goal of double the farmers' income by 2021. The Kisan Credit Card scheme was created with this in mind by the central government. Through this article, we will offer you all of the pertinent facts on the Kisan Credit Card Scheme. You will learn everything you need to know about this strategy by reading this post. What is the Kisan Credit Card Scheme, what are the benefits, features, eligibility, important documents, and application process, and so on?

Kisan Credit Card Yojana 2021 Overview

Farmers throughout the country will be given credit cards under the Kisan Credit Card Scheme. They would be offered a loan of Rs. 1 lakh 60 thousand as a result of this. Farmers in the country will be able to take better care of their crops thanks to this loan. Farmers will be able to ensure their harvests as well. The Kisan Credit Card scheme has been expanded to cover livestock producers and fishermen.

If you wish to apply for a credit card through the Kisan Credit Card Yojana, go to the official website and follow the instructions. Farmers will be given loans via the Kisan Credit Card Scheme at a 4% interest rate with no guarantee.

| Scheme Name |

Kisan Credit Card Scheme |

| Started by |

central government |

| Beneficiary |

farmers of the country |

| Objective |

To provide a low-interest tax credit |

| Application process |

online |

| Official website |

https://pmkisan.gov.in/ |

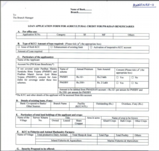

Kisan Credit Card Yojana Registration Process

A loan of Rs 3 lakh is provided for the harvest through the Kisan Credit Card Yojana 2021. Farmers must pay a 7% interest rate on this loan, and farmers in the country who want to benefit from this scheme must apply for a credit card. Today, we'll show you how to apply for a credit card through this program.

- To begin, go to PM Kisan Samman Nidhi Yojana's official website. The home page will appear in front of you after you access the official website.

- The option to Download KCC Form is available on this home page. This is an option that must be selected. KCC Application Form PDF will open in front of you after you click on the item, and you can download the application form here.

- You must fill out all of the information requested in the application form after downloading it. After you've filled out all of the required information, you'll need to attach all of your supporting documents to the application form.

- Following that, you must submit your application to the bank where your account will be opened.

Kisan Credit Card Yojana Required Documents

- Land that can be cultivated should be available to the farmer.

- Farmers who engage in agricultural production on their own farm, work in agriculture on someone else's farm, or are involved in any type of crop production can apply for a Kisan Credit Card.

- Aadhar card of the applicant

- The farmer must be a permanent resident of India.

- a copy of land

- card with a pan

- mobile phone number

- a passport-sized photograph

Kisan Credit Card Yojana Benefits

- This scheme is available to all of the country's farmers.

- The benefit of the credit card scheme Kisan 2021 would be granted to all farmers who are connected to the Pradhan Mantri Kisan Samman Nidhi Yojana.

- The national government would issue a loan of Rs 1 lakh 60 thousand to the country's farmers using this credit card.

- Farmers that take out loans under this scheme will be able to improve their farming practices.

- The benefits of this scheme will be available to the country's 14 crore farmers.

- Farmers' interest burden should be reduced.

Kisan Credit Card Yojana Eligibility Criteria

- The applicant's age should be between 18 and 75 years old.

- The presence of a co-applicant is required for people over the age of 60.

- All farmers who own agricultural land.

- Farmers should be brought under branch control.

- Farmers that work with animals will be eligible for this program, as will small and marginal farmers around the country.

- This system also covers those who work in the fishing industry.

- Farmers that cultivate on the rented property will be considered eligible for this program as well.

- This program is also available to lessee and tenant farms.

Kisan Credit Card Yojana Helpline Number

Helpline number 011-24300606

Read More Articles

.webp)