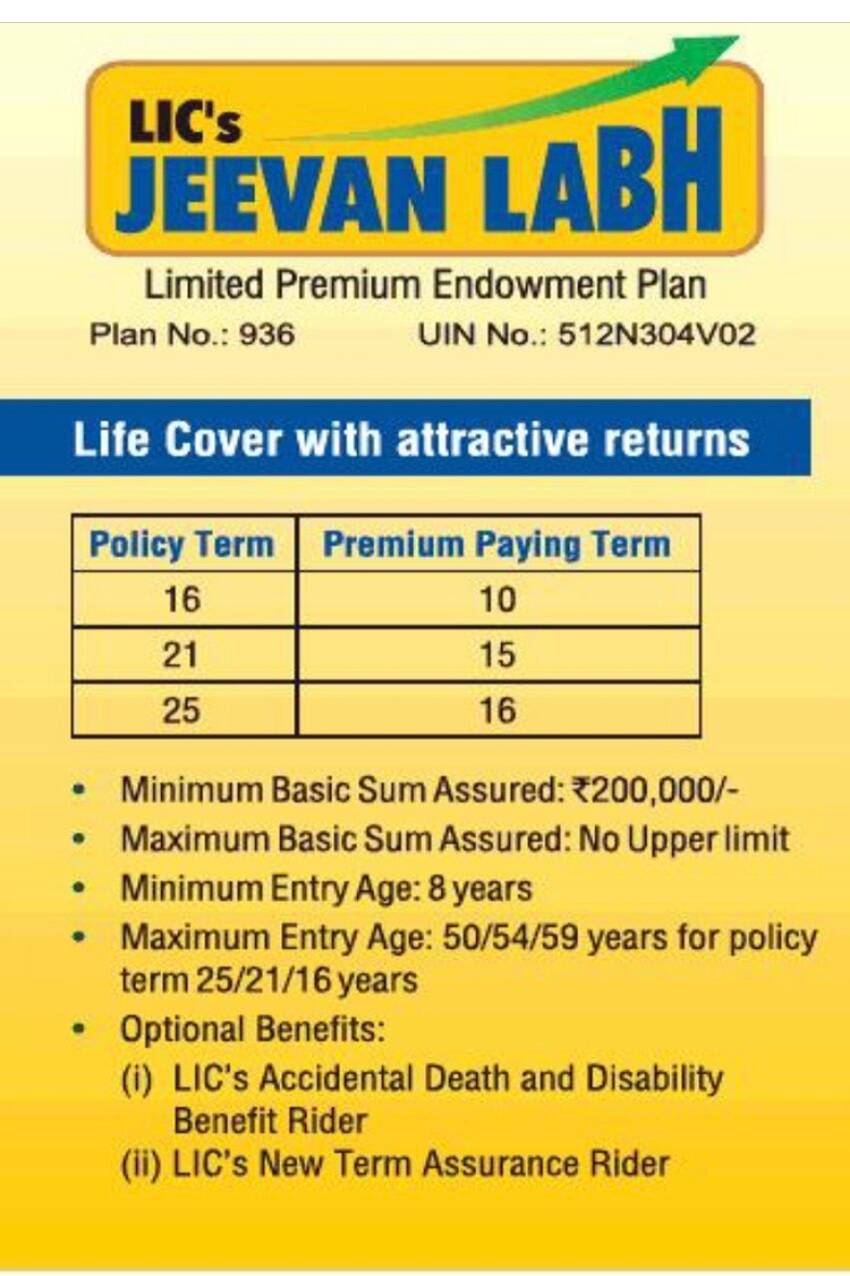

LIC's Jeevan Labh policy is a policy that gives a for-profit, unrelated endowment facility with limited top rate fee. LIC Jeevan labh presents beneficiary safety and savings with the help of the policy. Upon expiration, the policyholder can acquire the lump sum charge amount. This plan presents monetary help to the family before the expiration of the policy, in case the insured dies.

Assume you are 23 years old and feature opted for a 16-12 months transient plan and an insured sum of Rs 10 lakhs. In such a scenario, you will must pay Rs 233 each month each day for 10 years. in this way, a total of Rs eight.55,107 can be deposited to you. This quantity turns into Rs 17,thirteen,000 at adulthood, that is, at the age of 39.

Application form is available offline and online both. In online mode go to website and fill required details and submit. In offline mode go to any of the LIC branch and take the form and submit to the branch with required docs.

Also Read : Indira Gandhi Credit Card Yojana 2021

If the policy holder dies earlier than the expiration of the policy and until the loss of life the character has paid all premiums, the death gain of this coverage might be awarded to the nominee. The nominee receives the insured sum, the simple reversal bonus, and the very last trouble bonus.

Related Post : Rashtriya Swasthya Bima Yojana 2021

Address : Life Insurance Corporation Of India

Central Office

'Yogakshema'

Jeevan Bima Marg

Nariman Point

Mumbai 400021

Contact LIC Call Center at +91-022 6827 6827

SMS LICHELP <pol.no.> to 9222492224 or SMS LICHELP <pol.no.> to 56767877.

Email : co_cc[at]licindia[dot]com

Website : https://licindia.in/

.webp)