Stand Up India Loan Yojana 2022: Read Online Registration Form, Required Documents, Apply Online, Application form, Benefits, Eligibility Criteria of this Stand up India Loan Yojana. Download PDF to know much more information. Read much more information about beneficiary Yojana from here and brief details on the official website.

The Indian government has launched India's permanent loan program. Under the Yojana, bank loans are granted to some scheduled classes, selected tribes, and borrowers. These bank loans range from Rs. 10 lakh to Rs. 1 crore. With this arrangement, at least one class or tribe loan is provided and each bank branch is assigned at least one borrower to build up Greenfield. This organization can be an industry, a service, an agricultural activity, or a commercial sector. If the company is not a sole proprietorship, at least 51% of the majority stake must be held by SC / ST or entrepreneurs.

| Yojana | Stand up India Loan Yojana 2022 |

| Country | Govt of India |

| Concerned Department | N/A |

| Beneficiary | Indian |

| Mode of Application | Online Application |

| Total Budget | N/A |

| Official website | https://www.standupmitra.in/ |

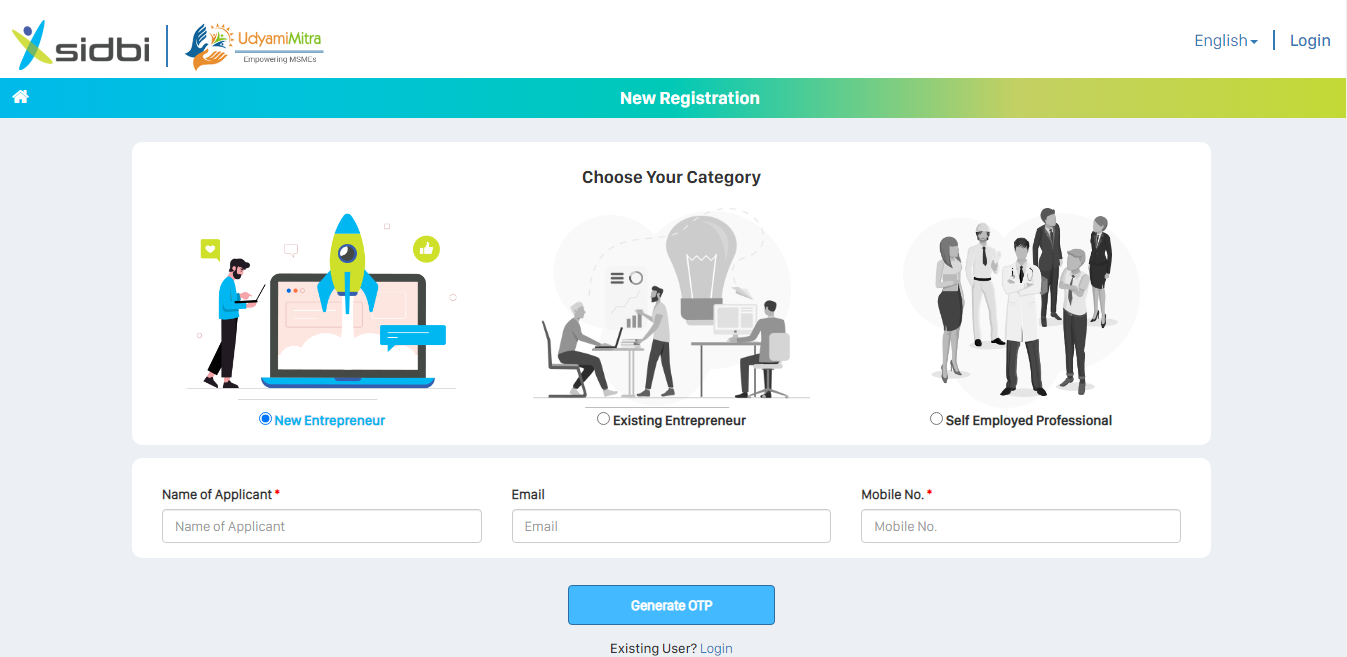

Step 1- Open the Official Website of the Stand up India Loan Yojana link click here

Step 2- Now click on this login option

Step 3- After that, this page will show you

Step 4- After reading the full instructions you have to click on Generate OTP

Aadhar Card

Caste certificate

Application loan form

Residence certificate

Age proof

Passport size photograph

Mobile number

The Indian government launched Stand up India loan Yojana.

Through these Yojana bank loans, some scheduled caste, tribes, and fixed women provide borrowers.

These bank loans will manage from 10 lakh rupee to 1 crore rupee.

With the help of this Yojana At least 1 class or trunk and at least one borrower woman only for each bank branch to prepare the Greenfield Foundation.

This setting can be produced, service or Agri, and trading field.

If the company is not individual, at least 51% of the maintenance and control and control of SC / ST from women entrepreneurs.

Under the composite Yojana, 85% of project costs, including forwarding loans and labor capital.

Interest rate, percentage of banks in this category should not be more than it (initial rate (MCLR) 3% tenor premium.

Unlike initial protection, the loan can be guaranteed by security or a credit guarantee for Indian loans, as determined by the bank to guarantee.

This loan must be repaid within 7 years as an optional period for 18 months.

To promote women's entrepreneurship in the SC and ST sectors, the Prime Minister of India, Mr. Narendra Modi, launched the Stand up India Loan Yojana. The program was launched on August 15, 2015, in order to strengthen the shareholders financially. The Yojana is also intended to help create jobs. This agreement enables shareholders to contribute to the country's economic growth. About 2.5 lakh beneficiaries will benefit from this Yojana across 1.25 lakh banks. In this article, we are providing you with full details about this plan including the purpose, benefits, features, eligibility criteria, documents required, online application, registration, application status tracking, etc. You should read this article for informatics knowledge carefully to the end.

These are the following Eligibility Criteria requirements for Stand up India Loan Yojana 2022: -

The applicant must be a permanent resident of India.

Applicant must be from SC/ST or a businesswoman.

The applicant must be over 18 years of age.

The borrower should not default on any bank or financial institution.

51% of the shares and control must be owned by an SC/ST or a trader in the case of an impersonal corporation.

This loan is only provided under the Greenfield Project Yojana.

Helpline Number: 1800-180-1111

Fax Number: N/A

Queries for: support@standupmitra.in, help@standupmitra.in

For more beneficiary Yojana read from here click this link: - Rajasthan Universal Health Care Yojana 2022

.webp)