Federal Bank Personal Loan: - Nowadays, everyone is looking for a good bank that offers personal loans. Personal loans are loans that do not require security or collateral. There is minimal paperwork required, and the loan funds can be utilized for legitimate personal needs. This loan is available from a variety of banks, but the federal bank has unique features that set it apart from the others.

Individuals can easily calculate their EMIs using the federal bank personal loan calculator, and loan applications can be accepted quickly using the federal bank instant loan offer. One can use the federal bank BYOM personal loan application online feature to apply for this loan from the comfort of their own home. Inquire about other banks' Personal loan features, eligibility, interest rates, tax advantages, and repayment plans. Go to our one-stop Personal Loan Page and clear your doubts in no time.

Federal Bank is indeed an important commercial bank in India's private sector, with over 1250 branches and over 1800 ATMs spread across the country. On April 23, 1931, the Travancore Federal Bank was established in Nedumpuram under the Travancore Companies Regulation. It was initially known as Travancore Federal Bank, but it purposefully transformed into a developed bank.

The bank provides a variety of banking services to its clients both in the United States and abroad. It provides various types of loans at active rates to adjustable repayment options. These loan properties include personal loans, which can be used by anyone to meet their needs.

Residents have access to this service.

The application must be a maximum of 60 years at the end of the loan term.

It is used to meet the personal needs of individuals who are assisting respected organizations or government matters.

A person's net monthly earnings of 25,000 rupees are required to be qualified for the loan.

An individual must have three years of experience in the current job to be eligible for the loan.

The federal bank has a number of distinguishing features that make it one of the best choices for a personal loan. The loan amount, interest rate, quick and easy processing, and so on are among the features.

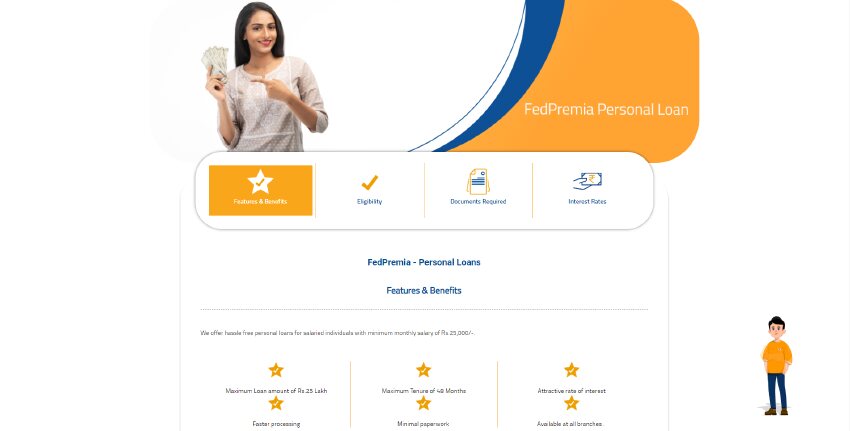

Flexible tenure: The federal bank's personal loan tenure is extremely flexible. It can be extended up to 48 months, giving an individual enough time to repay. One can even select a time that is convenient for them.

Suitable offers: This same federal bank personal loan provides fantastic loan offers. Individuals can take the loan based on their own needs and are not required to provide any security. The bank tailors the loan offer to the consumer's needs, making this same federal bank personal loan an excellent choice.

Interest rate: The interest rate is currently between 10.49% and 17.99% per annum. The maximum amount of the loan offered by the bank is also Rs. 25 lakh.

Extra fees: The federal bank personal loan has a low processing fee. It is only 3% when combined with the GST amount. A floating-rate personal loan has no prepayment penalties. If the rate is fixed, a 3% commission is charged.

Simple documentation: The paperwork for just a federal bank personal loan is simple and straightforward. For the loan to be approved, an individual does not need to go through a lengthy documentation process.

Repayment options: The federal bank offers a variety of repayment options for personal loans. One can select an option based on their needs. Standing registration just at the nearest branch is one option, as is automated payment via the Electronic Clearing Service.

Federal Shubh Yatra credit

Fedpremia Private Loans

Federal Easy funds

Fed-E-Credit

The documents needed to apply for a FedPremia personal loan are divided into two categories:

KYC documents:

PAN Card

Proof of address such as rental agreement, recent utility bills, passport, etc.

Identity proof such as Voters ID card, PAN Card, Passport, Driving License, etc.

2 copies of a recent passport-sized photograph of the applicant

Documents pertaining to income:

Salary slips for the previous three months or the most recent salary certificate

Income Tax Returns for the previous two years or Form 16

Salary Account Statement for the previous six months

Loan application form duly completed and signed

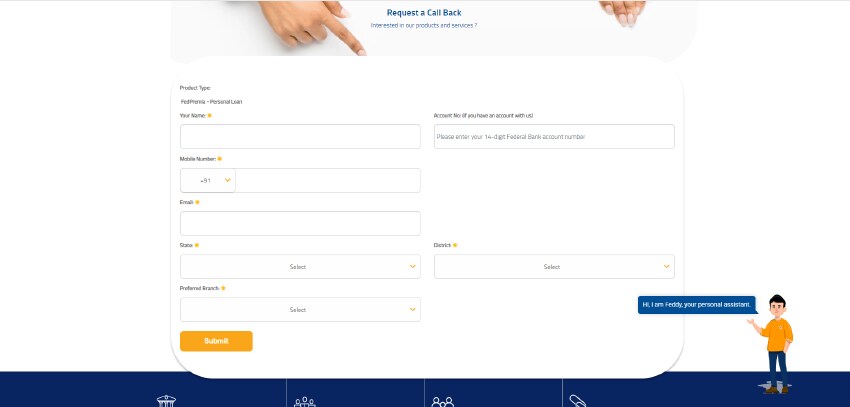

If you are interested in personal loans then click on this link: federalbank.co.in

.webp)